The process of VAT registration in Ireland, once relatively uncomplicated, has become increasingly complex in recent years. As you guide your business through various stages of growth, you will inevitably encounter VAT at some point. You may already be wondering whether to register for VAT or when might be the best time to do so. Most goods and services include VAT; therefore, companies must be VAT-registered to remain compliant with Irish tax law. Our tax experts have compiled this guide to provide a clear explanation of the VAT registration process and the conditions that determine when to register.

VAT, or Value Added Tax, is a charge added to most products and services available in Ireland, whether sold in Ireland or originating from outside the EU. VAT is also levied on certain Irish exports to the EU.

Essentially, it is a consumption tax which is charged at each stage in the production and distribution of goods or services. Although paid by the consumer, it is collected by businesses and paid to the government through bi-monthly VAT returns. Every VAT-registered business charges VAT on its sales and can claim VAT on the goods and services it purchases to conduct business.

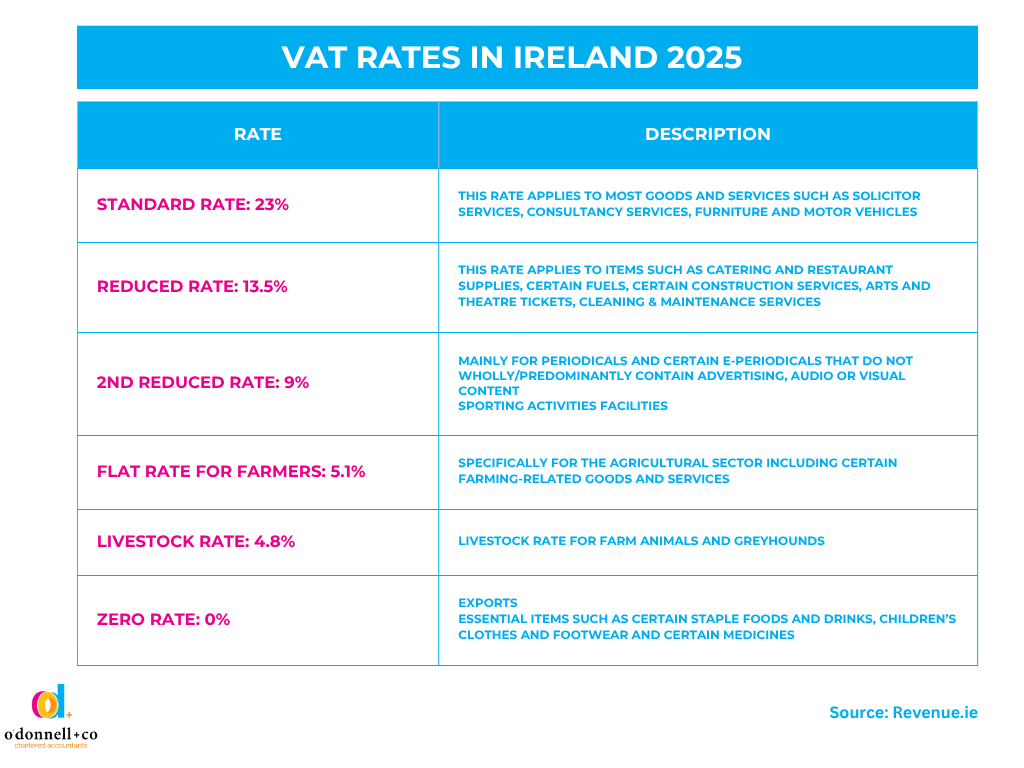

In Ireland, VAT is charged at different rates based on the type of goods or services offered. As you can see from the list below, deciding which VAT rate applies to your business can be quite a complex process.

See the current rates of VAT below:

Note: The table above provides a broad overview of the types of goods and services that each VAT rate covers, while it also demonstrates the complexity of the VAT rate system. Each business must ensure it charges the correct rate for its goods or services to avoid penalties. Therefore, if you are unsure of the proper classification for your business, you should contact a VAT expert for guidance.

Companies and sole traders can register for VAT in Ireland under the following circumstances:

There are three categories of registration for businesses to consider – domestic, intra-EU and Non-EU registration. Given the complexities of intra-EU and non-EU registrations, where each company requires a customised solution, this article will concentrate solely on the requirements for domestic VAT registration. However, if you need assistance with either intra-EU or non-EU registrations, our tax advisory team offers a tailored VAT registration and filing service.

Domestic businesses (companies, sole traders and partnerships) that trade in Ireland only must register for VAT if their annual turnover is greater than €42,500 for services and €85,000 for products.

While new businesses are not explicitly required to register for VAT, it’s essential to know the VAT registration thresholds in Ireland so that you can prepare your business for registration at the right time:

Revenue provides detailed information on VAT threshold levels.

As previously stated, the VAT registration thresholds for services and products are €42,500 and €85,000, respectively. When your taxable turnover exceeds this amount in a year, or if it is likely to exceed this amount, you must apply for a VAT number and register for VAT. We define taxable turnover as the total of all sales that are subject to VAT. Remember, timely registration is crucial to avoid penalties.

Note: in the case where your taxable turnover exceeds the respective amounts cited above, you need to register for VAT within 30 days of the last day of the month that you exceeded the threshold; otherwise, you will incur interest and penalty charges.

In a case where forecasting projects that future turnover may exceed the VAT threshold, it is possible to register for VAT voluntarily, although you must remain registered for at least two years.

New businesses are recommended to forecast turnover and, in cases where you expect your turnover to exceed the VAT threshold that applies, you should register for VAT voluntarily from the start.

Voluntary registration brings several benefits, particularly for startups and small businesses, as we detail below:

If you have registered for VAT, you can claim back the VAT you pay on goods and services purchased for your business. This applies to the pre-trading costs of setting up the company and is beneficial if your business requires expensive equipment, stock, or services that are subject to VAT. This is an excellent way for startups and small companies to reduce some of their startup costs at a time when they are most vulnerable. And, of course, it also applies to high ongoing expenses such as rent, software and outsourced services.

VAT registration strengthens the perceived credibility of a business, indicating that it has reached a certain level of turnover. It will encourage your suppliers and customers to view your business as professional, trustworthy and well-established. If you operate in a sector where all your competitors are VAT-registered, it also enables you to compete on a level playing field.

Running a business is very demanding as you juggle daily tasks with increasing paperwork and compliance requirements. As a result, it is easy to miss a filing deadline, so it is a good idea to register for VAT voluntarily. By registering for VAT voluntarily before you reach the threshold, you can avoid missing deadline issues and the penalties that result from late registrations.

Voluntary VAT registration is equally beneficial if your business sells zero-rated goods or services (for example, food, children‘s clothing and shoes), as you can still reclaim VAT on your purchases.

Companies trading in the insurance, financial services and education sectors cannot register for VAT and therefore cannot reclaim VAT on their purchases. If in doubt, it is always best to check with an experienced accountant before registration to determine if your products are exempt.

Tax registration form: If your company trades in Ireland, you can fill in the tax registration form online through the Revenue Online Service. If your business is based abroad, you will need to complete the paper form.

Provide Evidence of trade: Revenue requires proof, such as invoices, contracts, etc., that your company trades in Ireland – at o’donnell+co, we require our clients to provide the following list:

Assessment: Once received, Revenue reviews your application to determine if your business is eligible for VAT registration. This process takes about a month, assuming there are no delays or requests for additional information.

Approval: Once approved, you will receive a VAT number. However, if Revenue rejects your application, you will have to address their concerns and supply any supplementary or missing documents. If you resolve these issues, you can then resubmit your application. It is therefore advisable to apply well before the point at which you need VAT registration to allow for delays.

Post-Registration Compliance: All VAT-registered businesses must file a bi-monthly VAT return and pay any VAT due.

As soon as Revenue has approved your VAT registration, it will take about 14 days to receive your VAT number. Once approved, you must implement the following actions:

You can file your VAT return and pay online through ROS (Revenue Online Service). If the VAT you have paid on purchases exceeds the VAT you have charged on sales in a given period, Revenue will refund the difference to your bank account.

As previously mentioned, we always advise that you retain all VAT returns and their related invoices and receipts for at least 6 years in the event of future audits. If you have a VAT issue, you should keep all associated documents until you resolve it with Revenue.

In conclusion, VAT registration is compulsory for businesses when they operate in specific sectors and/or reach a certain threshold; therefore, it is crucial to know the conditions which govern VAT registration in your industry to remain compliant with Irish tax law. As always, if in doubt, seek the advice of an experienced accountant. If your company is about to exceed a VAT threshold or if you are considering voluntary registration, why not contact our tax advisory team for guidance?

You can apply for an exception to VAT registration if your turnover temporarily exceeds the VAT limit. For example, a one-off contract could cause such a situation. In such circumstances, you would have to prove that your taxable turnover would revert below the threshold in the next 12 months. If granted an exception, you won’t need to register for VAT.

You can only claim on goods and/or services that are used solely for carrying out your business. Examples are office supplies, computers, equipment, transport costs, services such as accountancy, HR, web services and marketing.

While they may sound similar, they are not the same. Specific sectors in Ireland fall under the VAT exemption status, for example, education and financial services. This means they are exempt from VAT altogether, so they neither charge VAT on their sales invoices nor can they reclaim VAT on the business expenses related to providing their service. On the other hand, businesses selling zero-rated VAT goods or services (such as daily staples like bread and milk) can reclaim VAT on related business expenses even though they charge VAT at 0%.

o’donnell+co offers a comprehensive VAT management service, from registration to ongoing VAT return management. Contact our experts to find out more about our tailored solutions. Choose o’donnell+co to avoid penalties and ensure VAT compliance with Irish tax law.