The tax return deadline, which falls in Ireland in October every year, is often the cause of stressful days and sleepless nights for even the most seasoned filers and business owners. However, while it may seem very complicated, filing a self-assessment income tax return in Ireland is simpler than you might think.

With over 25 years of wisdom and expertise in tax returns, tax planning and advisory, our team have compiled this “no-panic” guide that will enable you to breeze through your tax year with confidence. Full of tips and information, our guide will keep you on track, helping you avoid penalties while saving you time and money.

Obvious though it may seem, the first thing to understand is whether you need to file a tax return or not, and if so, what is the filing deadline? Secondly, we need to acknowledge that preparation for the tax return deadline should not start in the last month or weeks before the tax return due date! People often refer to the “tax season” as though it is a stand-alone period in the year.

However, experience has shown us that the least stressful way to approach your tax return is by preparing for it continuously, which means staying informed and organised throughout the year. In fact, although the paper deadline is October, you can file your income tax return as early as January for the previous year!

First and foremost, if you are an employee, your tax is paid at source from your monthly salary. Under the PAYE (Pay As You Earn) system, you don’t need to file a tax return.

However, if you earn money outside of your paid job such as rental income, investment or dividend income, you will need to file an income tax return. Below, we list the criteria that require you to file a self-assessment income tax return using Revenue’s Pay and File.

In all the above cases, the individual must register with the Revenue and use Form 11 to file their annual income tax return. The most efficient way to do this is to file online.

In Ireland, the tax year coincides with the calendar year, so January 1st marks the start of the new tax year. The tax return filing deadline is typically set for October 31st for paper filings each year, marking the last possible date to submit your tax return for the previous financial year. For example, in 2025, you must file your 2024 self-assessment tax return, pay the balance of your 2024 income tax and your preliminary tax for 2025 on or before October 31st if you are not filing online.

For those who file their returns and pay online through the Revenue Online Service (ROS), the final online submission date is usually mid-November (the date changes each year). However, this extension is subject to specific criteria and deadlines for preliminary tax payments. Filing online can help reduce the risk of late submissions, but it still requires the same commitment to efficient organisation and preparation.

January 1st:

January 31st:

Additionally, there are specific deadlines for submitting various tax reliefs and deductions. For example, if you’re claiming medical expenses or tax credits for tuition fees, the deadline to submit these claims is within four years of the end of the tax year in which you incurred the costs. Keeping track of these dates and understanding the timelines for different tax-related actions is crucial for seamless tax management and avoiding last-minute panic.

Preliminary tax is an estimate of what you expect to pay in Income Tax, PRSI (Pay Related Social Security) and USC (Universal Social Charge) for the current tax year. In simpler terms, it’s a prepayment of your expected annual tax bill.

Although it is an estimate, it is essential to note that interest charges will accrue if you miss the deadline or if you underestimate the tax due. The calculation for the amount of preliminary tax is subject to specific requirements and must be either:

Taxpayers should understand that it is their responsibility to ensure that they accurately report all taxable income and pay all due taxes on time. Accurate reporting means that they include income from various sources, including employment, investments, rental properties, and self-employment. It is therefore crucial that you know what constitutes taxable income and what deductions or reliefs you can apply to your tax return.

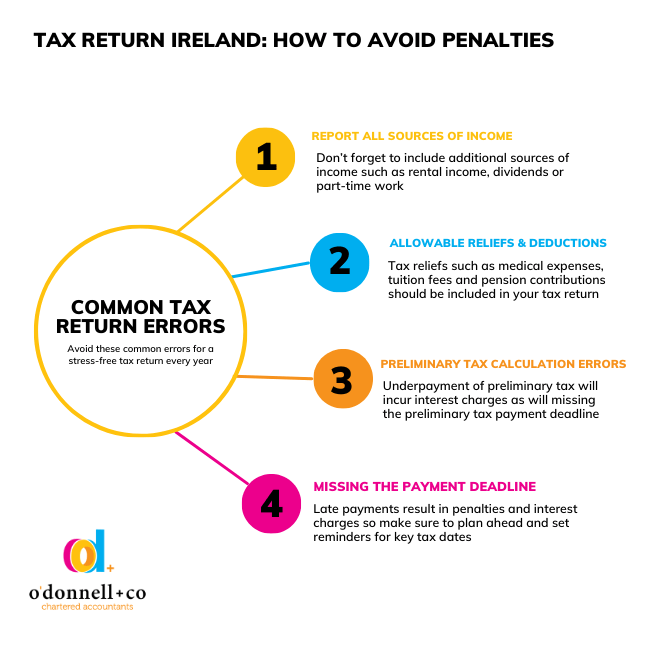

Ensuring that your tax return is completely accurate is a painstaking process, but it is worth the peace of mind in the long run. There are several ways to make the process stress-free and avoid potential delays, penalties, and unwanted audits. We detail the most common mistakes below and how to avoid them:

Not Reporting all Sources of Income: Failing to report all income sources, such as rental income, dividends or part-time work.

Not Claiming Tax Reliefs and Deductions: Claiming entitled reliefs such as medical expenses, tuition fees, and pension contributions can significantly reduce your taxable income and overall tax liability.

Preliminary Tax Calculation Errors: It’s essential to accurately calculate the amount of preliminary tax due, as underpayment will incur interest charges.

Missing the Payment Deadline: This is, of course, the most serious error of all and will also result in penalties and interest charges.

The key to avoiding all of the above mistakes is organisation: maintain thorough records, update your accounts regularly, understand the reliefs you are eligible to claim, and keep all related receipts and documentation in your tax file for the year. Lastly, use the ROS system for guidance and tracking payments.

Reliefs and deductions can be quite confusing, so it is no wonder that the input of an experienced tax advisor is a godsend when it comes to determining which reliefs you can or can’t claim. Irish tax law offers a range of reliefs and deductions for taxpayers – the most common are detailed below:

Medical Expenses Deductions covers unreimbursed medical expenses for the tax year, including doctor visits, prescriptions, and specific treatments. Again, depending on eligibility, expenses incurred for dependent relatives can also qualify, increasing the potential tax savings.

Tuition Fees cover approved educational courses, such as fees paid for courses at universities, colleges, and other approved institutions. Courses must be on an approved list, and registration fees are not eligible for relief.

Pension Contributions relief covers contributions to approved pension schemes such as personal pension plans, occupational pension schemes, and PRSAs (Personal Retirement Savings Accounts).

Mortgage Interest Payments: Landlords can claim relief on rental income, which includes deductions for expenses (e.g., repairs, insurance, and management fees) incurred in renting out their property, as well as interest paid on any mortgage on the rental property.

Charitable Donations: Donations to eligible charities and institutions can be deducted from your taxable income to reduce your overall tax liability. Taxpayers should ensure they donate to eligible organisations and keep proper documentation to claim this relief accurately.

Consistent organisation and an efficient filing system are the keys to success. In addition to setting aside time each month to update your accounts, plan ahead and start preparing your tax return well before the October deadline to identify information gaps and address any discrepancies. Keep all necessary documentation in a designated tax file, and keep a tax calendar with all the key dates and deadlines to ensure you stay on track.

At o’donnell+co, we require our clients to provide the following documents for the preparation of tax returns:

As this list suggests, it is a complex process that requires time and financial expertise, which is why many of our clients opt to use our tailor-made tax return service.

Missing the tax return deadline in Ireland has serious financial and reputational consequences, which include:

In conclusion, if you have missed your tax return deadline, the best course of action is to file your return as quickly as possible to try to mitigate the damage. In some cases, such as a family bereavement, Revenue may waive the charges if it feels that there is a “reasonable explanation”. In such instances, you should contact Revenue to explain your circumstances as quickly as possible.

As a final note, it may be helpful to approach your tax return from a different perspective and view it as a management tool. In other words, when you manage your tax affairs efficiently, you will maximise your savings, reduce your tax bill, avoid unwanted scrutiny, and ensure compliance with Revenue, all while enjoying the benefits of healthy finances and avoiding those sleepless nights.

Revenue’s website is an excellent source of information for taxpayers with detailed guides and FAQs on a range of tax-related topics and contact information for Revenue’s support services – see some of the most useful links below:

o’donnell+co offers a comprehensive income tax return service, from ensuring your financial records are maintained accurately to efficiently handling all tax-related tasks. Our accounting and tax planning services include: