Efficient payroll processing is a core requirement for all companies. Yet, it is one of the most complicated functions in a business: mistakes are easy to make yet difficult to fix, payroll processes are complicated and labour-intensive for your accounting team, and the constant changes in the statutory requirements of employment law mean that it is very easy to incur costly penalties. Therefore, it is unsurprising that many Irish businesses consider outsourced payroll services. Wouldn’t it be wonderful to hand your payroll over to an expert? The good news is that payroll processing is one of the most straightforward functions to outsource and can very often reduce costs. Aside from happy employees, the ultimate benefit is that the business can allocate its accounts staff to more important tasks such as financial analysis.

So, what exactly does outsourcing entail, and what are the benefits for your business? Which criteria should you use for hiring an expert payroll provider to run your payroll function? If you are contemplating any or all of these questions, this article will help you find the answers you need.

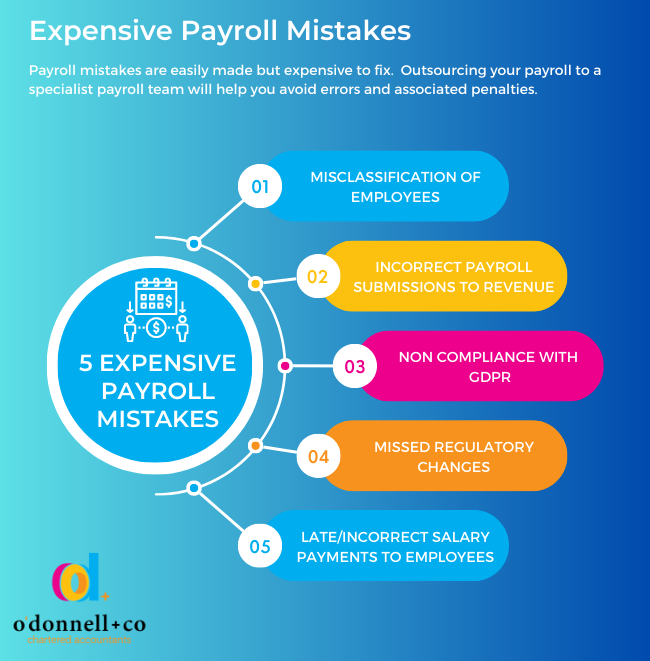

Essentially, outsourcing is when a business employs a third-party provider to administer all the ongoing and annual tasks necessary to ensure that employees are paid on time. An error-free payroll process must rigorously adhere to four principal criteria – accuracy, security, efficiency and regulatory compliance. We should also point out that it is not just about wage calculations – employees’ trust, motivation and retention levels can be negatively affected by payroll errors. Therefore, the importance of timely, accurate payroll cannot be underestimated. Our infographic illustrates the top payroll mistakes that prove very expensive for companies:

One of the main advantages of outsourced payroll is its flexibility. It can easily be tailored to suit the size of the client’s business. Smaller businesses often dismiss the notion of using a specialist provider to run their payroll due to cost concerns, not realising that delegating this complex operation to an expert can significantly reduce their overheads. In fact, outsourcing payroll can create new opportunities for many organisations by freeing up HR, Accounts and Admin functions. This can result in considerable internal efficiencies in the long run.

To answer the question of why Irish businesses move away from in-house payroll processing, we can turn to the top three benefits most frequently cited by our clients at o’donnell+co:

Irish payroll is carried out against a dynamic legislative backdrop. Tax and employment laws constantly evolve, making compliance more difficult to achieve as filing breaches are subject to significant penalties. The advantage of hiring an expert payroll provider such as o’donnell+co is that our expert team has the local knowledge and expertise to ensure payroll issues are handled professionally and help you avoid compliance breaches.

Payroll data is one of the most sensitive datasets within an organisation. It is essential to ensure that all employee information remains secure and confidential. Yet, no matter how trustworthy an in-house employee is, there are many opportunities for sensitive information to be accidentally disclosed. This is a serious concern for employers.

Specialist payroll companies offer the latest technology and payroll software and maintain strict internal protocols to safeguard sensitive employee information coupled with ongoing staff training and systems monitoring. These measures guarantee that employee and senior management data are secure and comply with GDPR requirements.

One of the principal incentives to hire a specialist provider is the potential reduction in payroll costs. Let’s consider some of the tasks that a payroll department carries out: constant monitoring of changing employment and tax legislation and GDPR, calculation of net salaries including issues such as deductions, paid and unpaid leaves, processing of overtime/holiday earnings, resolution of issues such as late payments, pension calculations and payments, preparation of audits and reports, to mention but a few! Clearly, accurate payroll is a highly complex process. It follows that outsourcing your payroll functions to a dedicated team of payroll specialists allows you to:

· avoid the expense of in-house payroll staff, training and investment in accounting software, and

· establish a pre-determined, fixed cost backed by expert support and advice as required.

Payroll providers offer various options depending on your business requirements. When considering external payroll management, the first step is to evaluate the current state of your in-house payroll processes. If you have identified several issues and problems in your Accounts Department, a fully-managed option is advisable. It will save you time, money and several headaches in the future! In contrast, partially-managed payroll services may be more beneficial if parts of your internal payroll system are running efficiently.

As the name suggests, this is an all-inclusive package whereby the provider runs your payroll process from start to finish and deals with arising payroll issues. You simply provide them with your business information, all employee data and records pertaining to PAYE, social insurance, pension payments, frequency of pay etc. The fully-managed payroll system is faster to implement but more expensive. It also requires that both parties establish efficient information-sharing systems, such as ensuring the delivery of timesheets and notices of changes to employee employment status on designated dates. Nonetheless, it is an end-to-end solution that gives you complete peace of mind!

This option means you handle basic administrative tasks such as recording timesheets and maintaining employee records. The payroll specialist is responsible for processing complex tasks such as payroll calculations, payroll taxes and deductions, year-end tax forms, etc.

In conclusion, both fully and partially managed options offer peace of mind by reducing the risk of data leaks whilst assuring success in the tricky field of compliance.

If you’re still wondering how managed payroll could benefit you, we would like to briefly illustrate how our team of payroll specialists have facilitated some of our clients:

The client needed to expand its operation into the Irish market rapidly. One key challenge was navigating the red tape of registering the Irish operation with Revenue.

The key benefits for the client are that our dedicated team were able to establish and maintain the company’s Irish payroll, arrange tax registration with the Revenue Commissioners as a “Non-Resident Company”, facilitate employee registrations with Revenue and provide guidance on local employment tax legislation issues. This enabled the client to streamline their expansion in Ireland to effect a swift, seamless start-up. Since partnering with o’donnell+co, this client has been able to add up to 100 new employees to its payroll.

Due to internal staff shortages, the client wanted to partner with a dedicated payroll team to manage the more complex and time-consuming tasks.

o’donnell+co’s payroll team work as an extension of the clients’ Accounts Department, processing payroll and providing management support when required. We also offer guidance on Company Directors’ pay issues, staff termination payments, and pensions reporting to the client’s pension providers. Our team reduces the workload of the clients’ Accounts Department, allowing them to focus on more complex accounting and financial issues. By managing our client’s payroll function, we ensure they remain current with all the latest tax and employment regulations. This means that they avoid costly penalties arising from non-compliance.

Our overseas client needed a reliable payroll processing and reporting system for a workforce of up to 1,300 employees located in Ireland. In addition, the client required a partner that would grow with them while acting as a natural extension of their in-house Accounts Department.

We facilitated the addition of 500 employees under TUPE, advised on termination payments to staff, processed additional payrolls for employee bonuses as required, and uploaded bank payment files for client approval. Our team’s expertise and knowledge of employment law have proved an invaluable support to our client. Additionally, we have handled many complicated, time-consuming pay-related tasks, freeing their Accounts Department to focus on core financial activities.

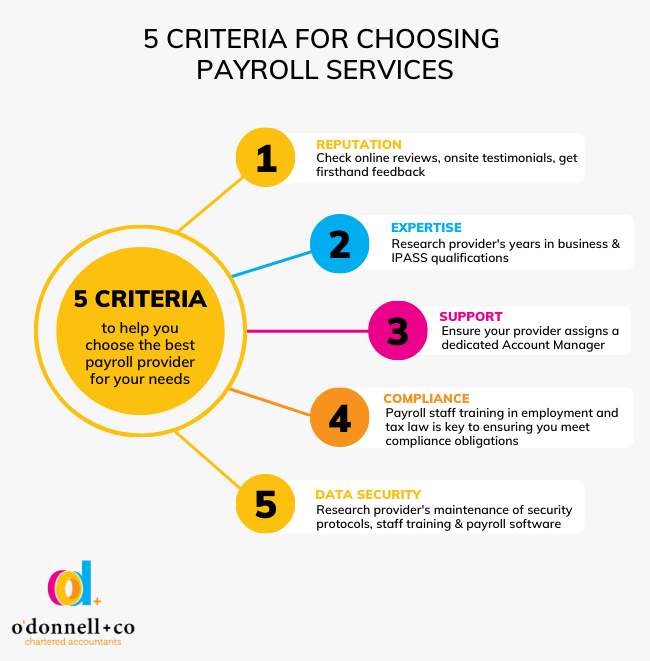

When researching potential partners, you should look for a provider who already manages the payrolls of businesses of all sizes. This would indicate that the provider can fulfil your current requirements but also has the flexibility to adapt to your future needs. Clearly, it pays to conduct thorough research into potential providers before making your final decision – below, we have listed the top 5 criteria that we believe are essential to forging a successful, long-term relationship:

To get an insight into a company’s services, you can check out online reviews on sites like Google Reviews and testimonials on their website and social media platforms. Another option is to ask the provider if they can put you in contact with some of their customers to get first-hand feedback.

It is also crucial that your provider has the expertise to run a timely and accurate payroll. Two key factors to look for here are the provider’s number of years in business and the qualification levels of its staff. Payroll staff in Ireland should be qualified at IPASS (the Irish Payroll Association) diploma and certificate levels. This guarantees they are fully trained in PAYE, PRSI, USC & LPT and employment and taxation legislation.

Timing is crucial in payroll management. Late payments and incorrect filings make for unhappy employees and potentially costly penalties for employers. Therefore, you should ensure that your payroll service provider assigns a dedicated account manager to deal with issues as they arise.

As already discussed, keeping payroll data secure is a top priority. When hiring a payroll service provider, you must ensure they maintain the highest security standards at every level – from staff training to maintaining secure, updated payroll software.

You could spend hours trying to understand the many tax and employment regulations. But why waste time when a professional team of experts and accountants can manage your compliance? And give you convenience and peace of mind.

If you dream of an effortless, stress-free payroll process, then it’s time to consider outsourcing. Why not contact us for a quotation and find out how our services can benefit your business? Our confidential, cost-effective payroll services include: